EXPERT OPINIONS

Textile waste transport in the EU - a problem that is only just beginning

Expert for waste logistics and transport route optimisation

Adam Zabroń

"Good logistics is not just about saving time and money, but a competitive advantage" - Adam knows that proper planning of waste transport routes is the key to efficiency.

Textile waste is increasing in Europe - so the topic is fast becoming a priority. EU regulations and new requirements for separate collection from 2025 are adding to the pressure on the waste industry, but also on the transport industry. Indeed, the various fractions of textiles - from second-hand clothing to residual materials - pose a major logistical challenge for transport companies, recyclers and sorting plant operators.

Are you looking for hauliers to transport your waste? Or are you a haulier yourself and looking for loads? Contact me

Scale of the problem

Textile waste is increasing across the European Union. With it, the scale of the challenges faced by the transport industry and the waste management sector. According to the European Environment Agency (EEA), around 6.95 million tonnes of textile waste were generated in EU countries in 2020. The average EU resident then generated around 16 kilograms of such waste per year.

Significantly, of this mass, only 4.4 kg per person went into separate collection systems allowing reuse or recycling. As much as 11.6kg per person, on the other hand, was mixed with municipal waste and in practice irretrievably lost for material re-cycling. In turn, this means that more than 85% of textile waste is still not being used effectively.

In the following years, this trend continued to worsen. In 2022, the estimated volume of textile waste remained at a similar level (around 6.94 million tonnes). Consumption of new textiles, on the other hand, increased to around 19 kg per person per year. This compares to an average consumption of 17 kg still in 2019. Thus, a clear increase in demand for textiles can be seen, which obviously leads to an increase in waste in this segment.

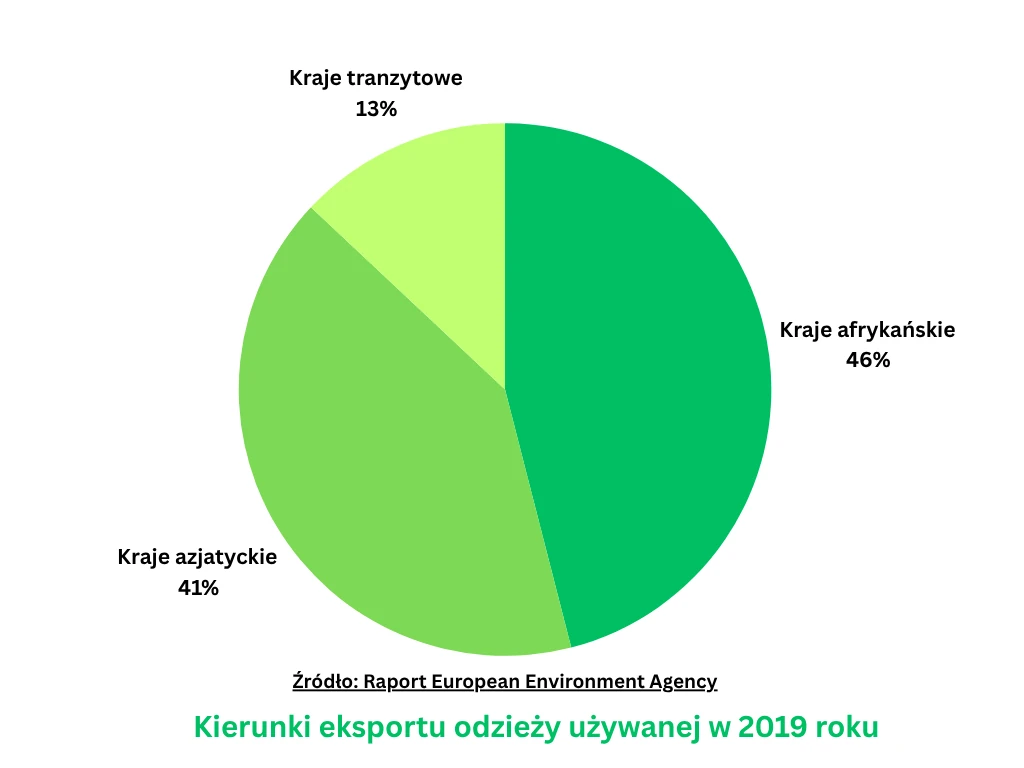

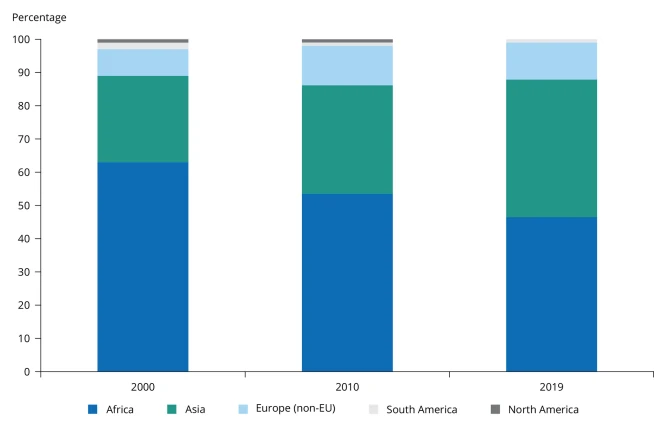

In parallel, there has been a dynamic increase in second-hand clothing exports from the EU. In 2000, around 550,000 tonnes of second-hand textiles were exported from EU countries. In 2019, this was already 1.4 million tonnes - a more than twofold increase. According to the EEA report The majority of these exports went to countries in Africa (approximately 46%) and Asia (approximately 41%). The remaining 13% to transit countries. There, the garments were re-sorted and sent onwards.

What is particularly important - Poland plays an important role as a transit and sorting country in the textile waste cycle chain. Many shipments of second-hand clothing pass through Polish sorting plants before reaching recipients in countries outside the EU. There, the materials are separated into valuable fractions, residual waste and goods that are subject to further export or disposal.

Where did textiles go when they were considered waste? Which countries accepted them? The answer to this question can be found in the referenced EEA report

Source: European Environment Agency (2023), EU exports of used textiles in Europe's circular economy, Figure 3, data: UN Comtrade (2022), available here

There is a clear trend here that the main market for EU textiles is Africa and Asia.

New legal requirements

Selective collection of textiles from 2025

According to the revision of the Waste Framework Directive, from 1 January 2025 all EU member states will are obliged to introduce a separate collection system for textile waste. In practice, this means that in each country the authorities will have to ensure that residents have access to bins or collection points dedicated exclusively to textiles. This waste can no longer be disposed of in bins for mixed materials.

The introduction of separate collection means one thing for the transport industry: a sharp increase in the volume of textile waste requiring organised transport to sorting plants, recyclers or downstream consumers. Already today, logistics centres, transport companies and collection system operators are preparing to handle the growing textile waste stream.

Changes in cross-border textile transport

The approach to the international transport of textile waste has also changed in recent years. Textiles destined for recycling or disposal are clearly classified as waste - and not as commercial goods. All thanks to the revision of the Waste Shipment Regulation.

This means that specific administrative procedures apply to the export or import of textile waste. In many cases, it is necessary to use a system of what is known as prior notification and consent procedure. This is the notification of a transboundary shipment of waste, which requires the consent of the environmental authorities in the countries involved in the shipment.

Importantly: it is no longer sufficient to describe a consignment as 'second-hand clothing'. If at least part of the cargo is waste or incomplete textiles, it will be necessary to apply the full procedures provided for waste shipments.

Carrier registers and the new role of documentation

In many EU countries, including Poland, hauliers transporting textile waste must be registered as waste hauliers in the relevant registers (in Poland this will be BDO).

There is also an increasing emphasis on full documentation of carriage. Both at the level of national and international declarations. Transport operators must expect that in future, not only will the relevant authorisation be required, but also the ability to track and report on the movement of cargo throughout the logistics cycle. This topic is being developed by the eFTI regulation, of which our expert Paweł Koszyński has already written.

Textile waste logistics - practical challenges

The transport of textile waste presents the industry with extremely difficult tasks. First of all, this waste is characterised by its low density and high volume. Balers and balers are therefore necessary, and this significantly increases costs. According to the EEA, the volume alone means that collecting 1 tonne of textile waste requires as much as several cubic metres of space - which translates into high transport and storage costs.

There is also a lack of sufficient sorting infrastructure in many EU countries. According to the latest data, more than half of the Member States are only just introducing separate collection, but this is not matched by the expansion of treatment facilities . As a result, a lot of waste ends up in landfills, is incinerated or exported, often without any real recycling.

Moreover, there is a serious risk of fraud in textile transport. The need to separate garments into valuable fractions and remnants generates the possibility of false declarations. Europarliament is considering extending textile export controls to prevent the export of increasing amounts of remnants - especially to countries in the global South, where they often end up in heaps .

The classification of the goods therefore becomes crucial - hauliers cannot simply label a load as 'second-hand clothing' to avoid procedures - such an action could end up in fines and detention of the shipment.

Transport of textile waste - Poland as a logistics hub

Poland plays a central role in European textile waste supply chains. The EEA and Fashion for Good reports confirm that, in addition to Germany, Belgium, Italy and the Netherlands, it is Poland that has become a key EU export 'hub'. Both second-hand clothes and waste end up in the country for further sorting and resale .

Polish sorting plants produce high-quality fractions for African markets (Nigeria, Ghana), Asian markets or for re-export. For example, textiles bearing the HS6309 and HS6310 codes arrive here from the Netherlands. They are then supplied onwards to Pakistan, India or Kenya. There, they are finally processed, sold or disposed of.

However, this creates image challenges. The industry is under the spotlight of environmental organisations and the media. Errors in classification or misleading declarations of fractions can result in inspections by the Environmental Inspectorate and even financial sanctions.

At the same time, the Polish infrastructure is developing. New sorting plants are being built, investments are being made in baling and logistics. This simultaneously opens up new opportunities for transport companies. The scale of the market is growing, so there are also opportunities for stable contracts - both domestic and foreign.

What lies ahead for the logistics industry in the coming years?

Textile waste will increase in the coming years. According to the EEA, it will exceed 7 million tonnes in 2020. Today it exceeds 15 kg/person/year. This necessitates the rapid scaling of sorting, the introduction of automated lines and fraction identification technology.

Companies must also demonstrate that they are using safe and legal logistics routes and that waste transport already has a strategic place in their service portfolio.

Further export restrictions are possible. The industry is already preparing scenarios in case textiles fall under the Basel Convention's control measures.

Summary

Textile waste transport is a growing challenge and an opportunity at the same time. The industry today needs diversification, technological tools, compliance with international regulations and knowledge of registers and permits. Investment in know-how and entries in registers such as the Polish BDO or Czech CRZP (or equivalents in other countries) is the best recipe for business stability and building a competitive advantage in payments and good communication. Flexibility in difficult moments is also key. The same applies to investing in carrier development and the use of modern technology. By implementing these principles, it is possible to build long-lasting, trusting relationships that benefit both parties.